When discussing the values of scrap DPFs and DOCs it’s important to understand the big picture. The presence of Platinum Group Metals (PGM) in diesel particulate filters (DPFs), diesel oxidation catalysts (DOCs) and three-way catalysts drives the recycled or scrap values of these parts. As explained in our previous article discussing the pricing of scrap DPFs and DOCs, engine manufacturers coat the substrates of DPFs and DOCs with varying levels of PGM (e.g. platinum) to provide a chemical reaction in the exhaust stream that enables engines to meet EPA regulated emission standards.

The monetary value or payout you receive from a recycler like Red Fox for scrap emissions control parts is based on two primary factors:

- The market value for PGM at the time of settlement

- The amount of PGM the manufacturer used when engineering/manufacturing a specific part

This blog post is intended to help explain the first factor, the metals market, and how global macroeconomic factors impact the current condition of PGM markets and thus the price you receive for your recycled DPF and DOC parts.

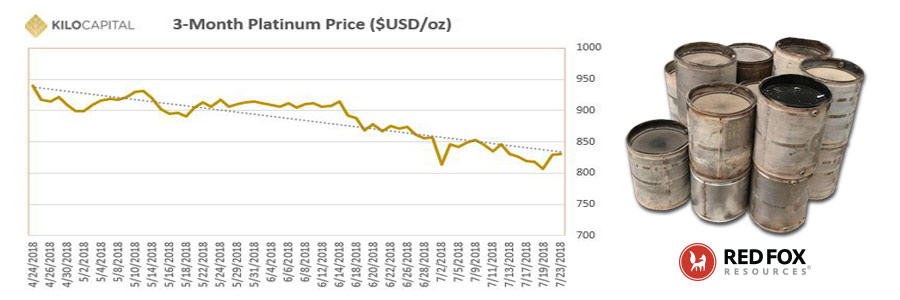

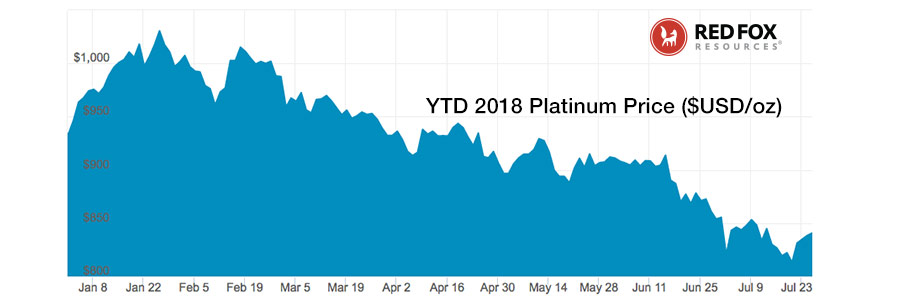

The first half of 2018 has not been kind to Platinum (Pt) which tends to be the primary platinum group metal used in catalyzed diesel emission control parts. The past six months have seen platinum prices drop 18% or $184 per ounce. July has seen platinum prices drop below $800/oz, something markets have not seen since 2004 (14 years).

What is Causing the Price Drop?

Commodity prices like PGM are driven through basic macroeconomic supply and demand principals. With those principals in mind, some of the drop in the Platinum market during the summer of 2018 can be attributed to the following:

- Reduced Demand for Platinum in Automotive Applications: Reduced demand for Platinum-based catalyst material in Europe for use in diesel-fueled passenger cars is being reduced. Some of the reduced production can be attributed to the Volkswagen emission standard cheating case (now referred to as “dieselgate”) and the resulting government actions moving automakers away from diesel engines. In addition to the government actions, recent buying trends show a customer preference for gasoline engines over diesel engines. While the actual demand for diesel engines has decreased as a result of “dieselgate” the biggest contributor to the drop in the market price of platinum is that investors have a long-term perception that the demand for diesel engines will continue to decrease over time as a result of not only “dieselgate” but also the shift to electric vehicles, which do not use platinum for emission controls.

- Minimized Threat of a Global PGM Supply Shortage: Concerns that South Africa, one of the top PGM producing countries, might reduce production of mined PGM have faded in recent weeks indicating there will likely not be a significant threat to global PGM supply.

- A Strong US Dollar: There is historical evidence to support the inverse relationship between the value of the US dollar and the commodity price of precious metals like gold, silver, and platinum. When the dollar strengthens, as we have seen over the past 3 months, investors tend to move away from precious metals, driving the price of metals down.

While Red Fox Resources has extensive experience valuing and recycling scrap emission control parts like DPFs, we are not economists trained to predict nor explain drivers in precious metals markets. For that, we turn to trusted experts like Wade Brennan, CEO at Kilo Capital, an industry leader in precious metals financing and trading. Kilo Capital publishes weekly updates on the precious metals markets.

“Platinum once again tested sub 800 as Europe moves from diesels and the outlook for any production cuts in South Africa fades. On the brighter side, there has been some chatter regarding a pick-up in forward buying of platinum for 2019 by the auto industry.” – Kilo Weekly Update Report, July 23, 2018

How Does This Effect My Recycle Payouts?

When you receive a quote or a payment from Red Fox Resources for scrap DPFs or DOCs, those prices are based on the spot price of metals on the day we receive the parts or the day you agree to a quote we issued. So simply put, a scrap part in which you received $100 for on Jan 23, 2018, would now fetch a payment of $81.80.

Hopefully, this article helps explains how PGM markets impact the price you are receiving for your recycled parts and why the checks you are receiving in the summer of 2018 are lower than payments previously received from Red Fox. As always, should you have questions about the Red Fox pricing or if you would like to receive a quote, get in touch via our contact page or call 1-844-733-3695.

Hopefully, this article helps explains how PGM markets impact the price you are receiving for your recycled parts and why the checks you are receiving in the summer of 2018 are lower than payments previously received from Red Fox. As always, should you have questions about the Red Fox pricing or if you would like to receive a quote, get in touch via our contact page or call 1-844-733-3695.

If you are interested in receiving updates on the precious metals markets, we’d recommend you subscribe to the weekly market updates published by Kilo Capital at www.kilocapital.com/reports.

Frequently Asked Questions | How It Works | Get A Quote

For more information, please contact Tripp Heller at 1-844-733-3695 or email at Tripp.Heller@RedFoxResources.com.